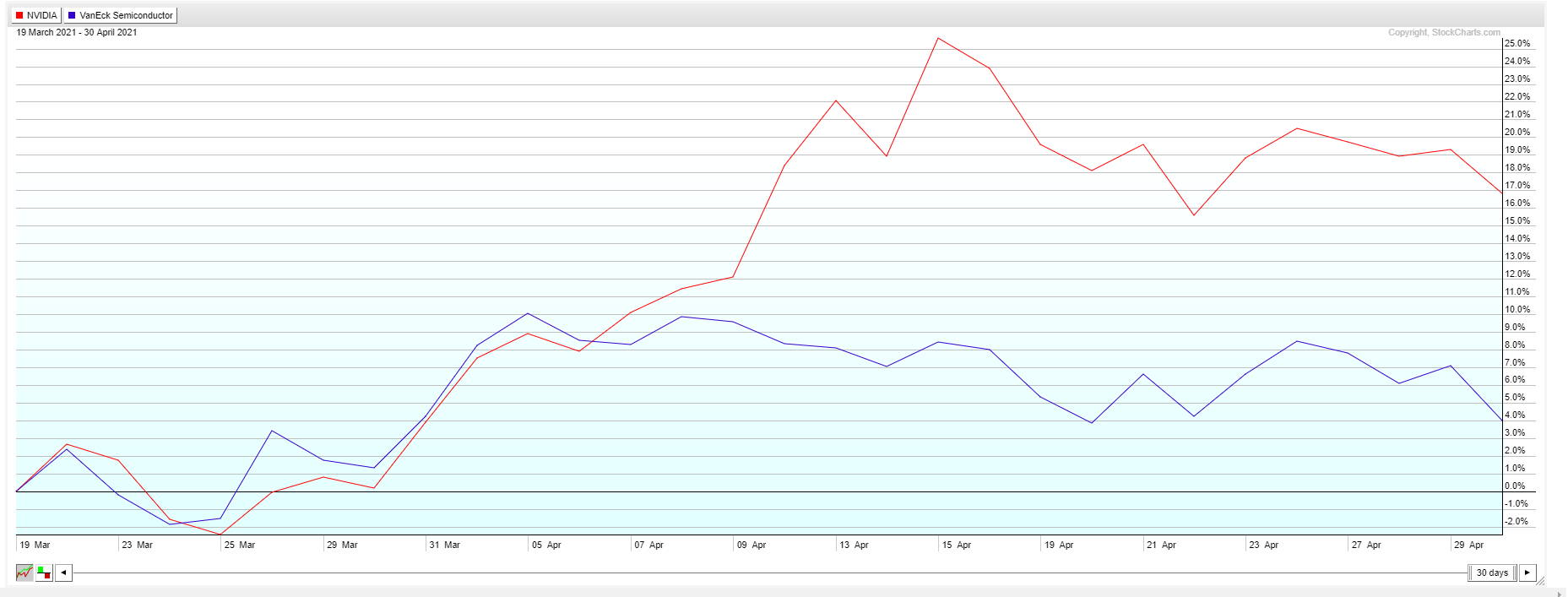

5 Longest Uptrendsįor your information, here are the 5 longest uptrends using 30-day SMA. Recommended Reading: NVDA 52 week high low report will let you know the highest and lowest days, weeks and months in recent times. The average price of stock during the 30 Days SMA longest uptrend was 180.86 $. We have displayed below the prices during the longest uptrend (up to maximum of 10 rows) for you to get a feel about the trend movement. The longest uptrend was between -26 for 23 days. Similarly, when the curve moves down, the price is trending downward.īased on 30 days SMA, the total number of uptrends and downtrends observed from the graph are the following. Whenever the SMA curve moves up, we call the price is trending upward. NVDA Trend Analysis: Ups And Downs In 52 Weeks The SMA changes direction less frequently than the price.The SMA curve is much smoother than the price. The price oscillates (swings) more frequently than the SMA.In the above graph, the blue line represents the price and the brown line is the moving average (SMA). The canceling out of volatility helps one see the real trend amidst daily price swings. As you can observe, the moving average is less volatile. In the first section, we are going to analyze the 30-day SMA of NVIDIA Corporation (NVDA) share price for recent 52 weeks between -18.īelow graph will show both the price and SMA of NVDA stock.

0 kommentar(er)

0 kommentar(er)